Some Ideas on Paul B Insurance Medicare Advantage Agent You Should Know

Table of ContentsThe Greatest Guide To Paul B Insurance Medicare Supplement AgentGetting My Paul B Insurance Medicare Advantage Plans To WorkAll About Paul B Insurance Medicare Part D6 Simple Techniques For Paul B Insurance Medicare Part D

person and have actually ended up being "lawfully existing" as a "competent non-citizen" without a waiting duration in the United States To confirm if you're qualified for a SEP, contact us."When individuals first go on Medicare, they're usually relatively healthy as well as not believing necessarily concerning when they're ill and what kind of strategy would be best for them because scenario. The inability to quickly switch back and forth in between Medicare Advantage and Medicare Supplement makes it rather made complex for people," she says.

While they're a slam-dunk selection for some people, they're wrong for every person. Additional benefits: Medicare Benefit strategies may consist of some expense savings or aids towards hearing, dental and vision treatment, which aren't covered by Original Medicare. Reduced costs: Several Medicare Benefit plans have no month-to-month premiums, and also out-of-pocket prices may be less than those for Initial Medicare.

Not known Incorrect Statements About Paul B Insurance Best Medicare Agent Near Me

This restriction is identified by the Centers for Medicare & Medicaid Providers, and it can be as high as $8,300 in 2023. Provider option: On Medicare Benefit, you have less flexibility to pick your medical carriers because you commonly must utilize providers within your plan's network. Traveling constraints: Numerous strategies call for that you reside and get your nonemergency treatment in the strategy's geographic service location.

Possible for instability: There's an opportunity your Medicare Benefit strategy could end, by the insurer or the network and its included clinical companies., which covers doctor's gos to.

Paul B Insurance Medicare Advantage Plans Fundamentals Explained

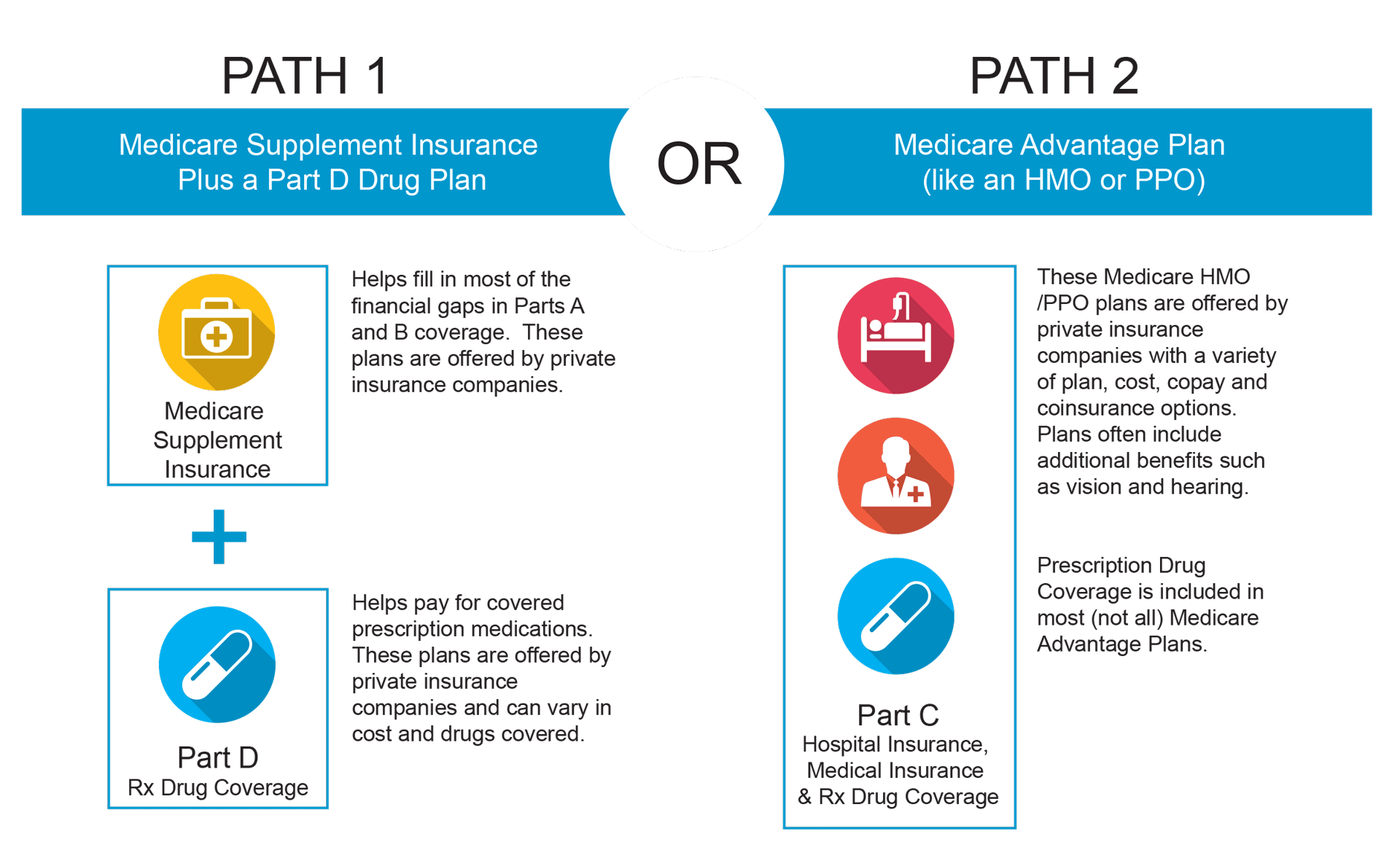

That cap can be as high as $8,300 in 2023. Original Medicare has no out-of-pocket restriction, although if you have a Medigap plan, much of your out-of-pocket prices are covered. Medicare Benefit plans are occasionally confused with Medicare Supplement Insurance Policy, also understood as Medigap. Both are offered by personal insurer, yet the means your expenses are covered is different.

When you seek healthcare, most or all of your expense share will certainly be covered by your Medigap plan. For this, you'll pay a month-to-month costs. Medicare Advantage plans, by contrast, are bundled plans that consist of the exact same protection you 'd get with Medicare Part An and also Part B (and typically Part D), plus often limited coverage for various other things, like some oral solutions or an allocation for some non-prescription medicines.

6 Easy Facts About Paul B Insurance Medicare Advantage Plans Shown

You'll pay copays or coinsurance when you look for medical treatment. With a Medicare go to this site Benefit strategy, you'll pay out of pocket whenever you see a service provider, as well as there's an out-of-pocket limitation on covered care of up to $8,300 in 2023. Also, because Medigap policies are standard, it's fairly simple to compare costs.

You can authorize up for a Medicare Benefit strategy if you have Medicare Component An and Component B and also if the strategy is offered in your area (Paul B Insurance Medicare Part D). United, Healthcare/AARP Medicare Benefit plans are the most prominent plans nationwide, with 28%of Medicare Advantage registration. Medicare Benefit intends, additionally called Medicare Component C plans, run as exclusive wellness plans within the Medicare program, serving as coverage choices to Original Medicare.